It seems that a month can't pass by — in the past couple of years — when investment analysts, games industry figures and Nintendo's own investors aren't saying that Nintendo needs to expand and release games on alternative platforms. It's creeping into discourse around the Wii U due to the hardware's struggles to date, yet it's been a theme most prevalent around the 3DS; the mass-market presence of smartphones and tablets has led to inevitable questions about the viability of dedicated gaming portables.

Of course times change, and the 3DS has enjoyed sustained 2013 success around the world — after a troublesome start in 2011 — and enabled Nintendo to maintain a degree of profitability when spending heavily on Wii U development, marketing and swallowing its low sales. Unsurprisingly, considering Nintendo's repeated and often-proven mantra that software sells hardware, this success has been driven by a year of heavyweight game releases; most, tellingly, developed and / or published by Nintendo itself. Nintendo gamers know the list by now, including (among others) Pokémon X & Y, Animal Crossing: New Leaf, Luigi's Mansion: Dark Moon, the recent The Legend of Zelda: A Link Between Worlds and others besides. There have been recognisable brands, critical acclaim, diversity in genres and a steady release lineup; once Nintendo's development teams and partners are in full flow the results can clearly sustain a hardware renaissance.

The 3DS has, as most gamers and members of the media would surely agree, enjoyed an excellent 2013. It was understandable, then, that in a recent interview on GT.TV Nintendo of America President Reggie Fils-Aime became visually exasperated (briefly) when the topic of smartphones and tablets was raised as a potential direction for Nintendo. Here's what he said.

The fact of the matter is we create systems that have buttons, that you interact with in a variety of different ways, because it makes for a better gameplay experience. That's the primary reason why, for us, this is not a proposition that makes a lot of sense. Now, separately, we could talk about all the financial and profit reasons why not to do that, but for the player, in the end, it's not as good an experience.

The argument over gameplay experiences can go around in circles, so let's touch upon the key point that's often overlooked; would it make financial sense for Nintendo to release its content on smartphones and tablets? Fils-Aime hinted in his answer that, given the inclination, he could make valid business arguments to counter claims that Nintendo's profitability would improve with that strategy. While we may not have access to all of the details of the business, focus group results and so on, we can at least consider some key aspects of this argument and question whether those that make such claims about the idea's validity are doing so out of short-term speculation, or genuine business insight.

Let's start with some major video game publishers, brands familiar in the dedicated game system space, and assess their successes and failures at present with mobile content. Square Enix is perhaps the first that will spring to mind for Nintendo Life regulars, especially, as a company that has produced 3DS ports on smartphones and even built up excitement over reveals that transpire to be a smartphone release. It's a company targeting the mobile market by utilising the Final Fantasy brand, in particular, trying various cost models in the process.

The company's most recent financial reports highlight an ongoing aim to expand online gaming experiences alongside accelerating "the production of titles for smart devices". The chart below shows that in the first six months of this year, games for smart devices and PC browsers are on course for similar levels to the last full year, with the overall trends being revealing.

These games are an important source of revenue for Square Enix, that is clear, but not the goldmine of irresistible momentum and revenue some may perceive them to be. For some companies the market can also, frankly, be difficult to understand, with the task of turning tens of millions of downloads into tangible profits not a guarantee. Take this relatively recent New York Times article on Disney's smartphone products to date, and it emphasizes the challenges of the iOS / Android games market model. It's possible to achieve tens of millions of downloads and yet struggle to translate that success into solid profit, an equation with which Disney Interactive is still grappling.

But switching to the free model has by and large been difficult for Disney, analysts say, with Exhibit A the crucial Where’s My Water? franchise, which started as a paid download and became a free app with in-game purchases for the sequel. (After completing multiple free levels, players must either take a forced short rest or pay 99 cents to $16.99 for added play.)

The sequel was released on Sept. 12 and, despite lackluster reviews, became Apple’s No. 1 download that weekend. But the game languished at No. 180 on the iPhone top-grossing chart and No. 193 on iPad, according to App Annie, a mobile analytics firm. People were playing, but not paying.

In Disney's case, the challenge is overcoming the issue of charging for a game upfront — going up against the substantial range of free games — or going the in-game purchases route. Christa Quarles, Disney Mobile’s general manager, admitted that the free-to-play Where's My Water 2 didn't generate the revenue the company hoped — "We struggled. There are not a lot of examples of successful transitions from paid to free-to-play." Capcom seems to be another company struggling to translate ambition in the growing smartphone market into results to satisfy board members and investors. In its most recent financial results briefing, the publisher at one stage hailed the growth of the smart device market, before then ultimately acknowledging that while titles such as Monster Hunter 4 and online experiences are performing well, the smart device market is yet to hit its mark.

However, mobile contents did not achieve expected level of sales throughout the period under review, due in part to lack

of major titles and the fierce competitive environment.

In the interest of balance, of course, it should be acknowledged that some recognisable gaming brands are rather pleased with progress in this market, notably Sega. It's most recent results cited positive trends with its smart device content.

Performance remained favorable in the field of digital game software for mobile phones, smartphones, and PC downloading, with the number of registered IDs for the online RPG “Phantasy Star Online 2” exceeding 3 million cumulatively on August 19, 2013. Among titles for smartphones, “CHAIN CHRONICLE” continues to perform robustly, exceeding 0.8 million downloads cumulatively on September 18, 2013.

Of course, we're often directed to details of games and companies that represent the biggest successes, which is the norm for any platform. The phenomenal performance of Angry Birds is perhaps the best known example, with Rovio's IP becoming a cultural behemoth. Yet with hundreds of thousands of apps these examples are the exception due to the crowded nature of the market, with visibility and sustainability issues impossible to completely ignore.

The mobile space can also fluctuate wildly, with Draw Something 2 a good indicator of how fortunes can rapidly change in a marketplace of short memories. Its predecessor was a phenomenon that made developer OMGPOP one of the hottest commodities in the business, prompting a big money acquisition by Zynga — an estimated $200 million. As outlined in this pocketgamer.biz article, that original saw its — admittedly staggering — level of success fade after the takeover by Zynga, and the inevitable sequel struggled to generate revenue on a scale to justify the investment made by the new parent company; after release it reportedly peaked at #74 in the grossing ranks. In what must go down as one of the most extraordinary high-value acquisition gaffs, Zynga faced difficulties from heavy investment for poor returns and shutdown the division — among other studios — in which OMGPOP had been absorbed.

It's an incredibly volatile marketplace that can also lead to wild variations in market value. GungHo Online Entertainment is a major success primarily due to smartphone game Puzzle & Dragons; we reported ourselves in May that the company's market cap had surpassed Nintendo's, with eye-watering profit levels. The company is still earning hundreds of millions of dollars per financial quarter, but it was reported at the end of October (thanks again, pocketgamer.biz) that its market cap was now around $9.3 billion, dropping from the $15 billion figure in May. The company is countering this drop in profit levels with moves into new markets including, yes, Puzzle and Dragons Z on 3DS.

Let's be clear, we're not ignoring key facts about the smartphone and tablet gaming market — it's a notable success, continues to grow at seriously impressive levels, provides a range of content accessible to a broad range of gamers, and is a business opportunity for developers and publishers of all sizes. What we hope we've also highlighted, however, is that it's not a land of easy gold and honey, but rather a tough marketplace packed full of competition and encountering some issues. It's the site of as-yet-unresolved pricing concerns — as is the "conventional" retail games market, admittedly — as a race to the bottom and free apps can lead to questionable and occasionally scandalous "freemium" models, while those that charge up-front for games try to convince consumers that their game is more worthwhile than a rival that has no initial cost. It's hugely competitive and tough to crack for the vast majority, with big fish such as Square Enix, Capcom, Disney and Sega having varying degrees of success.

What's key to the Nintendo smartphone content debate isn't what it would gain from bringing major releases of its intellectual properties to smartphones, but what it would lose. Not only would the company enter a market prone to wild fluctuations and steep challenges, but it would — potentially fatally — undermine its strongest business. It's the portable that would suffer most; the DS family of systems is the biggest-selling handheld console in history (narrowly behind PlayStation 2 in the overall stakes) and the 3DS is Nintendo's current leader; if the current portable wasn't performing, the Wii U to date would have done greater damage to the company's sizeable balance sheet. A key point for the 3DS, beyond its form and value offering, is that it's the only place to get certain Nintendo content. The moment Animal Crossing or The Legend of Zelda appear as all-new fully-featured games on smartphones, is the moment that Nintendo will arguably destroy the asset that's served it so well. The company wouldn't be where it is today without the lineage of Game Boy — in its multiple generations — to DS and now 3DS.

When you look at Nintendo's greatest successes, in fact, it is handhelds that have delivered the most reliably substantial sales; it's in home consoles where results have fluctuated a good deal more. For its flaws and mis-steps, and it does make them, Nintendo has been right to avoid even tentative major releases on smart devices, even if it's correct to explore opportunities to expand the likes of Miiverse and — perhaps in future — eShop purchasing options accessible from any online device. The company's made clear that it will consider options to utilise the omnipresence of smartphones and tablets to promote its own platforms and products.

But as for games, for the immediate future Nintendo should stay well away. It's becoming increasingly true, as third-party support fluctuates, that consumers are most attracted to Nintendo systems for its first-party games, while some other exclusives and occasional multi-platform games add extra flavour. Nintendo's is also a business model where a financial loss, any loss, comes as a surprise, as it's often run with frugality and to make a profit in even the toughest times. Let's not forget that, despite the Wii U's undeniable troubles, the company has been in the black in the past two financial quarters, with analysts projecting profits below Nintendo's own targets for the year — but profits nevertheless.

One mis-step or short-term profit chase on iOS or Android could have major consequences for Nintendo's presence as a hardware producer, eventually leading it to be a software-driven company such as Sega, Square Enix, Capcom et al. That would be a sad day indeed, especially as the company produces consoles with a different approach to the rivals from Sony and Microsoft, and as we've shown it wouldn't necessarily bring the guaranteed runaway glory as consolation.

We'll let Satoru Iwata close, urging long-term security over short term priorities when speaking to the Wall Street Journal (via The Verge).

If I was only concerned about managing Nintendo for this year and next year — and not about what the company would be like in 10 or 20 years — then I'd probably say that my point of view is nonsense.

But if we think 20 years down the line, we may look back at the decision not to supply Nintendo games to smartphones and think that is the reason why the company is still here.

Comments 132

The mobile market is full of so many crappy and stupid games. There are very few really good mobile games. Nintendo is better off controlling the handheld market. They make tons of money and created a loyal fanbase in their handhelds.

Reggie speaks the truth! It's a much better experience when a game has actual buttons. Now I'm not totally against touch screens - but a virtual D-Pad is nowhere NEAR as good as an actual one. Touch screen controls like that lack precision. I'm glad that Nintendo's sticking to their guns - sure, there's some shovelware on their handhelds, but it's nowhere near as much as there are on iDevices.

I'd hate them if they moved to mobile phones, because I hate to play with ONLY a touchscreen, I want some buttons to that too! Plus, I like playing by the TV too, and with their own consoles, they can also make unique gameplay, which they have done several times.

....Why do they want Nintendo games to move to smartphones so badly...they keep saying Nintendo is doomed. If you want to play one of Nintendo's games, BUY THE STUPID SYSTEM ALREADY! lol

@Blastoise-san agreed i got a good phone (as i needed a new one) for use and so i culd play all thes "Top notch" android games.... iv enjoyed about 3? If that. even then thow there locked in sweep slash games witch get everso dull and 1 MMO that iv enjoyed and thats it tbh... i dont even look naw -_- id hate to see Nintendo's games tern it to that...

"People were playing, but not paying." This is the fundamental problem with smartphones gaming, aside from lack of quality as we are used to on our consoles/PC. People are willing to pay 0.99 cents at most. Nintendo should stay as far as possible from this market, Android/iOS are devaluing games with the freemium or 99 cents mentality.

@Mizore ahh but that requires them to have some logic and to not be ignrant 8P

The mobile market is incredibly fickle and unpredictable. There's no guarantee for success. Angry Birds is entering a phase of cash-grabbing and I won't be surprised if it flops in this phase.

Thank you, Thomas, for such a thoughtful and insightful article. I was supposed to go to bed 10 minutes ago but wanted to finish reading it.

This is a great editorial, Mr Whitehead, one of your best!

The key point is that a move into the smartphone market COULD be a success for Nintendo, but it's far from the sure-thing home run a lot of analysts seem to suggest. There are some big numbers floating around the mobile market at the moment, but there's also a certain unstable Wild-West feeling to the whole thing. This is an extremely new frontier for gaming, and I'd argue that the market is still in the process of coalescing; as such, we're seeing fluctuating performances from even the biggest companies, fleeting trends and some boom-and-bust economics governing things. It feels like the dotcom industry in the mid-90s, and I'd wager we're going to see as many spectacular failures as huge successes over the next few years before things stabilise.

What guarantee do Nintendo have that they'd be one of the success stories? I can't see much evidence for it. The mobile market seems completely alien to their sales models, business principles and software design ethos, and I would imagine they would have a hugely difficult time adjusting. And crucially as you say, any move into that market would be a one-way trip - once they've started releasing their content on mobiles for mobile prices, it'll be a stake through the heart of their current handheld business. There'd be no going back; it's an all-or-nothing bet, and I can't see any compelling reason for Nintendo to take it, at least not right now.

@Samurai_Goroh Agreed fully.

@DarkwingLz Agreed and Angry Birds is also incredibly overrated...just...like...you know... Call of Duty.

Good editorial!

Some additional quotes from the referenced article that caught my eye:

" "Free-to-play requires a different set of design muscles and all companies are struggling to adapt, Disney included," said Joe Minton, co-chief executive of Digital Development Management, a video game talent agency.

Disney must step carefully because of its focus on young players. Consumer protection groups are concerned that children are being asked to buy things during the heat of game play; Apple recently settled a class-action lawsuit over in-app spending by children. A few child advocates question whether freemium games are appropriate at all for family entertainment companies, calling it a casino-style business in which most revenue comes from a relatively small number of big spenders."

How relevant is this to Nintendo? It's no secret that freemium games (which dominate the smartphone market) are designed to be cash-grabs hidden behind cute graphics.

Nintendo is a family-friendly company that has a huge appeal for youth. Exactly how they are supposed to enter a market where their target market and friendly reputation are in direct conflict with the predominant business model is a question that gets glossed over far too often.

I actually want Nintendo to use smartphones to augment the experience of Wii U games. I'd love to play some trivial grass-cutting mini-game on my phone and then take it home to link to my Wii U to earn rupees in my Zelda save game.

Basically, let me do stuff in the line at the bus stop that I don't want to waste time doing at home.

@Mizore Yep exactly, lol. Some people just don't want to have multiple electronic devices I guess... they want to play everything on their smart device...

Agree with all the points in this article. A very small minority of titles on smartphones may make a very large sum of money but the amount of truly dire free content is staggering.

I play a few games on my andoird phone and some are quite fun but I normally always aim for ones that are buy outright games; the micro-transaction system in most is completely infuriating. It ruins the design of the games because all their mechanics have to be built around leaching money from players to generate revenue rather than producing and enjoyable game that generates revenue as a result of its quality.

I think SE fails to take into consideration how much bad ports damage the Final Fantasy brand.

Besides, the mobile market is so volatile. One game in a hundred thousand may go on to be the next Angry Birds or Candy Crush. The other 99,999 will be garbage shovelware that turns people off of the whole thing.

This is a great article and well written, but seems to miss the elephant in the room a bit. I'm also of the mind that the best games are not to be had on a phone but one of the biggest gripes for Nintendo users is the slow trickle of classic games from old systems and the high pricepoints when they do release.

So if Nintendo were to release and control their own classics (NES/SUPER NES) for mobile at their own prices (5-10$) probably with the obligatory free advertising for actual new nintendo games for real consoles, they would sell like hotcakes and make Nintendo a fortune, show their relevance without watering down their position as leaders of their own platform.

It doesn't matter how bad we say angry birds is, it's fast and cute and cheap, and it wouldn't hurt Nintendo to acknowledge that there is a place for this style of gaming and flex their own muscle in that market with THOSE KINDS of experiences including their nes classics that are still better than most mobile games.

No one here wants them to put development muscle into new mobile games, but would anyone with a smartphone NOT buy super mario brothers if nintendo were to release it there?

@Ren Very good point.

@Ren Yeah, I did miss the VC angle. What I would say that I think it'd do damage, still, as moving content away from its own hardware takes away control and, ultimately, strips the 3DS of a selling point. Also, frankly, Super Mario Bros. on a phone is less enjoyable because of physical inputs. Yes, people can by controllers for iPhones etc, but they're not mandatory or particularly widespread.

@Ren

You drive a good point, but I have to disagree with you. It would make their eshop games and VC games on the eshop irrelevant. Why would you pay money to Apple, when you have your own eshop system already in place.

Excellent article btw.

Actually Nintendo could embrace the mobile market with some cheap apps to please Nintendo fans. Maybe wallpapers, ringtones and quizzes for example

I wouldn't mind Nintendo making a phone, but only as long as it doesn't replace their current handheld. (And their phone would more then likely have buttons)

But Nintendo making games on the iPhone and Android? No way. I haven't played a single good game, and will only play those when standing in line for something.

Nice article btw.

@ThomasBW84 Not sure that is the whole picture Square Enix stuff is pretty expensive as far as far mobile stuff goes. Rockstar has grossed more from their ports of the early GTA games. (Which you can play just with a £2 otg adapter and a wired 360 pad perfectly - you just plug it in and it works). Them doing that hasn't affect GTA5 whatsoever.

Cellphones for Nintendo? I'm fine with the occasional app, but no way, shape, or form should they move their business towards them. To be honest, cellphone gaming has kind of stalled out over the year, while 3DS and Vita gaming has skyrocketed.

Nintendo can stay Paid and enter the mobile market just fine. They can even slap on some innovation to whatever smartphone they produce. Consumers like having that WELL MY PHONE DOES THIS HURRR.

Yes the 3DS is doing fine now, but it's bolstering the Wii U. One or both of those legs could fall at any moment, if you want to talk about wild market fluctuations. The consumers at large didn't want the 3D, and the tablet console is continuing the declining, forecasted numbers that were the reason for the Wii in the first place.

Nintendo needs to pursue mobile. Not as a tremendous money maker, not as an answer to a problem, but to stay in the consumers' eyeshot. And with the right controller or hardware buttons, the full games on the phone would be just as good.

I think it's a better strategy to get the mobile games onto Nintendo platforms, which is what they are allowing devs to do.

If the mobile market want to be a video game market, they need to make the full transition. You can't have a phone or tablet that does some things, but not the other and expect it to have any relevance in comparison to a full out system like the 3DS.

If a company has a system of their own. It makes no sense to publish elsewhere. You'd be killing your own hardware sales.

@DarkwingLz There's already a Pokédex app! Stuff like that is perfectly fine, in my opinion.

Angry Birds and Cut the Rope are already on Nintendo systems, that should make it pretty clear where the mobile games that are worth your time are, or should be going.

@SCAR392 It is undoubtedly going to be the case that All Stars Racing Transformed couldn't be any worse on a tablet than it is on the 3DS. For situations where they try and put the same game onto the 3DS and basically anything else then the mobile version will be more than likely much better with a real controller.

I think the reason most people on here fail to see the appeal of mobile gaming is because they're just imagining current games ported onto phones. Of course those are going to suck. Games built from the ground up with those devices in mind can be as great as anything on a console. Device 6 has a higher meteoritic score than every game released on a Nintendo console this year with the exception of SM3DW. There's no way that game would be any better with a controller.

If Nintendo ported 3DS games to mobile they probably would suck, but if they made all new games designed around touch only inputs, there's no reason why they can't be as good as anything on a handheld. It will never happen, but it's nowhere near as stupid as most on here think it is.

@unrandomsam

That's a 3rd party dev, though. Sega doesn't have its own systems, anymore.

Just imagine searching for a Mario or Pokemon game on the Play Store or App Store and finding a ton of clone games popping up in your search results.

It's basically business suicide.

Dat Pikachu girl.

I like touchpad devices, but let's face it, the games are temperamental and not fun.

@Peach64

There's just way to many costs involved to make anything profitable on smartphones/tablets. Apple takes a very large cut of the profits, and there's developer licences Nintendo would need to pay for to put something on the App Store.

It just isn't worth it since they already have an eshop.

@SCAR392 If Nintendo was publishing their own stuff on Google Play that would be cleared up pretty quickly. Big test tomorrow is going to be for me which is the best : Xperia Play - Sonic 1 Mobile Port or 3DS Sonic 1 3D Classic.

(No preconceptions going in).

@MoonKnight7 The cut they currently giving the retailer is almost certainly more than that. Look at game.co.uk eshop code prices - Say game sells a code at £32.99 with profit so Nintendo is selling it for less to them. Nintendo's eshop price is £39.99 - Apple's cut is 30%. Probably worse for them going with Game.co.uk if you look at the numbers.

Smartphones were never designed to play games. They were designed to simplify complex multitasking. I don't understand the point of having DVD in a video game console nor do I understand the point of having apps like youtube on 3DS. What benefit does that give?

And secondly, its about time Nintendo should sue Google and Apple for allowing emulation. Thing is they don't want to do it because more people will begin to hate Nintendo and when that comes then people will try to get rid of Nintendo by competition.

Tell me companies that are far richer than Nintendo and those are the ones that will do anything to get Nintendo's control.

sorry to be digressing again but why cant we get more 3dsXLs like that in the photo. 3dsXL has to be the worst designed handheld ever. Its not clean/smooth/simple yet effective/apple like at all. Its just plain boring brick

@unrandomsam

Why would Nintendo put effort into making a different platform when they can apply that same effort to their own? It's not even about the hardware, here. Google and Apple just don't maintain their online shop offerings and don't have all the controls that most people want.

Like I said, if Nintendo published on iPhone, their games would be showing up right next to the Mario clone. Nintendo would get mixed up with all the other junk on those stores.

There's only like 500 of the 4 million apps on iPhone that are even worthwhile, IMO. At this point, Nintendo is better off not committing business suicide. Google and Apple got some serious cleaning up to do with their online shops.

Excellent article that clearly outlines why Nintendo should never dilute their brand value with sub-standard phone games. A long term vision instead of short term gains is the Nintendo way and the right way.

I don't think Nintendo should be making 3DS or WiiU games for smartphones, but I could see them making companion apps for their games. A pokedex app for example, or something along those lines.

@unrandomsam

But you'll still be at the mercy of apple/google in terms of restrictions and guidelines. They just don't want to jump through their hoops when they already have their own digital space.

I would like Nintendo to make a limited edition 3DS phone and put this discussion to bed. Just a rudimentary but reasonably functional phone and keypad on the back of a 3DS. Maybe if they wanted to make it a premium product they could make it 3/4G capable so the 3DS can be played online. Give the phone a separate operating system so the phone and console always run smoothly. I would buy it and I am sure Nintendo could make another few limited edition runs if it didn't flop. Doesn't have to take on iOS or Android but it would allow fans of Nintendo a chance to have a phone that played proper Nintendo games. One of the reason I've not got a 3DS is because I already have an expensive handheld device that I take with me everywhere.

If Nintendo were ever forced into making iPhone games, I am sure they'd make good original ones but they'd be butchering their classics if they just ported their entire library.

Here's my thing.

I don't think it has to be all or nothing, black or white. I think Nintendo would do well to start developing games that are specifically tailored to mobile platforms. Putting Animal Crossing and Pokemon on iOS is completely ridiculous. But making a simple endless-runner-style game with Mario on it and putting it on the app store isn't such a bad idea at all. The 3DS is for deeper games with real controls, so it wouldn't do any harm or cannibalize its market share to make quick, shallow experiences for the people that just plain aren't ever going to buy a 3DS. Basically, make games for two different audiences that aren't going to cross. If anything, playing Nintendo games on their iPads might even spark interest in the deeper experiences offered on 3DS. It's like getting a taste.

And even if they don't start making simple games for mobile devices, they could at least pay attention to the pricing model. If the app store is currently engaged in a "race to the bottom" and we can get a lot of great games (anyone who pretends like there aren't a lot hasn't looked) for next to nothing, why are we still paying $5 for some terrible old NES games? Even the still-great classics are hugely overpriced. Why would I pay ten bucks for some dumb little time-waster on the eShop when I can get the same thing on iOS for a buck or free? I'm not saying everything on the eShop is overpriced, but a lot of the games could do with a great price reduction. Nintendo needs to look at each game and price them accordingly with regards to amount of content and the price of competition. Don't make everything free, but at least take note of what others are doing. A buck for a game that they made 25 years ago is still a huge profit, considering all they've had to do since then is port it around. (Though I suppose this entire second argument could be considered moot, seeing as everyone continues to buy old Mario games again and again and again...)

@SCAR392 Think Nintendo would make more money with the VC available everywhere. Say 2 years behind the 3DS same price. Move the 3DS VC onto GBA. (I suspect there are quite a lot of iOS sales where the games are never even played like Gunstar Heroes which with a touchscreen would be a total waste of time). They hardly put any effort into it as it is so it more than likely is making an insignificant amount. (The retina ipad's are probably one of the few devices capable of doing a decent scanline emulation (Due to having so many pixels) so that older stuff actually looks right and they are 4:3). Tablets now are much better technology than the Vita.

Nintendo won't change though. The money comes from Retail 3DS games that have no real equivalents on mobile. (Other than best of the best classic stuff perhaps but the porting quality on Android is not high enough).

@DerpSandwich It is possible it could draw attention to how god awful the 3DS hardware is though (In that developers put in as little effort as they can if it is not easy to get 60fps they won't bother for the most part). You would have to really try to make anything look worse on a modern ipad than a 3DS.

@unrandomsam That's definitely a good point. I could imagine a kid playing a game on his retina display iPad and going, "Hey, maybe I'll try one of those 3DS things!" only to pick one up and be like, "Oh, dear lord! What are there, like a hundred pixels on this thing???" XD

Really great article, very awesome to see the truth put out there. This proves that Nintendo definitely should not jump ship to existing tablets & "smart"phones.

If they released their own phone with their own operating system software it's a big risk because it would definitely need physical controls & still be portable like a phone. Technology moves so fast with phones they'd have to chuck out a new one each year just to keep up with the other phone makers. Then there's the software pricing side of things, since it's their own phone they could price games how they want but since people expect 99c or free then Nintendo would be pressured to far undervalue their games just to stay competitive. All-in-all it's a really bad/dumb idea in my opinion.

Of course it's not the answer. It would destroy any reason left to buy their hardware.

But there will inevitably come a day when it will be the only choice.

@unrandomsam

There are still some pretty bad quality games on iPad, though. I had Dead Space on iPad 2. It was absolute garbage compared to what the 3DS could possibly do. The only benefit in that case, was HD.

They would make money on mobile platforms, but it would kill long term success for short term. Phones and tablets get replaced by consumers every year. There's a point where software is no longer compatible and there are alot of other factors to consider here, than just "put the game on mobile".

3DS won't be replaced until 2017 or 18. Apple will release an new iPhone or iPad every year, and there's no guarantee that software will always run based on how Apple operates their platforms.

Nintendo has more control over their platform, and it's for the better. Becoming 3rd party is not the way to go, especially on such a small scale as mobile when said mobile device companies don't exactly have a better UI and online shop. The mobile platform shops and variances in hardware are the deal breaker. Not to say there was ever a deal, but I think you get the point.

@SCAR392

Excellent point.

I have Shantae: Risky's Revenge on DSiware, and when I found out it was also on iOS, with a new costume, and for free, I tried it, only to be constantly confused with its no-button interface. I see Reggie's point...

Don't hate.....But I've turned into a "Only handheld Gamer" no, not smart phones....that crap is lame, just 3DS and vita! Nintendos next system I hope uses hdmi output all they need is there handheld with 3D and hdmi (incase you wanna see it big). I'm also a retail download gamer, which I've spent 1000's on the Eshop with my 128GB card....hoping for unifidy account system lol....:/ the wii was a fad, there last good system to the players was SNES...let the home console die and Rock the handheld world like you've always done! Meh sorry rant...doesnt make secne, on da sause ^.^ maybe edit later when less saucy

There are games that work great on a smartphone/tablet interface: Plants vs Zombies, Angry Birds, Candy Crush, and Temple Run. Outside of that genre the controls are bad at best. All the games I have attempted on it either were bad or horrible experiences mostly ruined by the control interface (Final Fantasy Games, Real Racing 3) or just bad experiences attempting to milk money from people from microtransactions.

Correct me if I'm wrong but I believe Angry Birds went from phones to consoles and tablets. Hmmm... looks like there's still some interest.

NIntendo going over to mobile=lower quality development and immerse experiences. Im not knocking off mobile by no doubt however the market for it is on shaky waters.Nintendo just stay on the platform you are on please.

Nintendo will be fine. They will have ups and downs just like EVERY BUSINESS THAT'S EVER EXISTED.

Everyone, calm the fudge down.

This article is fantastic.

Only Nintendo could make a smartphone game that you would want to play, even when outside of the washroom.

@SCAR392 Yeah but there is bad ports on the 3DS. (Lots of them). There is a great Dead Space on the Xperia Play (That I got for free when I got the device with some EA offer)

@antipop621 I think Super Hexagon is better than anything on the 3DS so far. (And if it was on the 3DS it would be the best game on it think the 3D with it would work brilliantly).

Right on Nintendo Life. Your article expressed what I've been thinking about for awhile now. Investors today seem to only care about short term profit instead of long term. It's what caused the American housing crisis so we definitely don't need to use this same tactic for our precious Nintendo games.

@allav866 It is possible to get it right. Bastion is a good example.

If Nintendo goes to smartphones they'll do it in their own way meaning that they'll create the platform itself and try to avoid the race to the bottom mentality that plagues the smartphone markets.

Smartphones "gaming" apps are the lowest common denominator money-grabs of entertainment. ex. (tap button, get prize.) A trained monkey will do as well on this. Nintendo games should and will stay and there own consoles. Also, this will sum it up nicely...

Smartphones "gaming" apps = Bubonic Plague

I hope they all never make money on the iPhone App Store. It was Steve Jons dream for independent developers to succeed on the iPhone and not businesses. It's unfortunate corporations took over that market and have made it unappealing to all.

@Zelda_28 Lowest Common Denominator is exactly what Nintendo does these days with all the lets make it good for newcomers. (So that if it is anything other than the first time you have ever played any game then it is a total joke).

This piece seems very well done. Very good context provided as far as the business of mobile goes. It's clear that mobile is not a gold mine for most software makers. Nintendo is not in such a dire position that it has to go that route. Nintendo's problem could be what comes after the 3DS. It will be interesting to see what Nintendo has in store as well as how mobile phones impact the market for dedicated handheld systems. It's nice to hear a corporate exec talk about long-term plans.

@unrandomsam

Making games with newcomers and advanced players in mind makes much more business sense than ipad/iphone games.

Came for the cute girl; stayed for the article.

@ThomasBW84 - Another well written article TW, really good, though it does seem a bit 1-sided.

A few opposite points.

1. What @Ren said. Older games would be money makers. NL already covered a bunch of cheap rip-off clones, why not make money on the real thing?

2. Nintendo already makes "App" like games. Go put in Nintendo Land and play the racing game or balloon game or DK tilting car game. Do any of those 3 use any buttons? Why can't they be $1.99 each on iOS or Android? I'm sure Game and Wario has some similar games. So I don't want to hear any BS from either Reggie or Iwata about how they need buttons to make games because they already actually DO MAKE GAMES WITHOUT BUTTONS. Wii Party U probably has some as well.

3. If Iwata is worried about the future then he should be on phones and tablets. Phones and tablets are where kids start gaming today. How many 3DS owners started on a Gameboy? Kids today start on their parents phones. When they get older they may not even want to touch buttons, and nobody who has electricity is going to be without a cellphone. Heck the phone companies are talking about doing away w/ POTS. If you want the kids of today to be playing your games tomorrow then you need to advertise to them.

4. It's not about making money, it's about advertising. Disney may not be making money w/ Wheres My Water 2, but you know what, everybody knows about Where's My Water, and most people know Disney made it. Marketing. Advertising. 2 things Nintendo has done very poorly w/ Wii U. Maybe if some Wii U minigames were actually on some smartphones and tablets people would known the Wii U existed before SM3DW came out. And throw of couple of those Captain Toad levels out there as well. It's not about making money for Apple and Android, it's about spending money to keep the Wii U alive.

@nintendork666 My thoughts exactly

@rjejr Yes there are games that could be done on a smartphone by Nintendo. Nintendogs being a prime canidate. Animal Crossing being another easy game to port over (especially since it includes pure stylus controls). There are mini-games that could transition well also as you said. However, I think doing so would be a mistake.

The biggest factor that makes Nintendo Hardware unique is Nintendo Software. Much like the biggest factor that makes Apple Computers unique is Apple Software (OS and Apps). Both make software primarily to showcase the potential and increase the sales of their hardware. I believe it is safe to say that you will see Nintendo games on other consoles/smartphones about the same time that you see Apple Computer port iWork, Garageband, Final Cut Pro, iPhoto and iMovie to Windows and Linux and offer iTunes and Safari on Android.

@Peach64 The only thing I'm going to nitpick is your defining "Metacritic score" as an empirical measure of QUALITY. Make 40 games like "Device 6" (and, at this point, I'm sure they will) and I would likely show you at least 39 that will get marginal Metacritic scores because they are "too much like Device 6", which will no longer be novel (pun not intended).

Otherwise, I think you not only make valid points that touch devices need different type of games for their hardware, but points that Nintendo has already followed. They were doing "touch" games on the DS before the iPhone existed, and Nintendo prides themselves on marrying their gameplay to their hardware, which is why they still choose the bespoke/proprietary hardware route. If Nintendo decided to design for hardware without buttons, they would certainly make games that would appropriately eschew the need for buttons. However, they recognize that the types of games that don't need buttons are very LIMITED in their ability to accurately control in a way that we would all perceive as fun or possibly even "games".

Imprecise controls and imprecise feedback can only create so much interactivity and they recognize that. This is why they will not port their games to that hardware, nor will they build hardware that functions exclusively in that way.

The only thing that would actually doom Nintendo was if they actually did put there games on mobile etc. I really hate the media when it comes to Nintendo news.

wow, @rjejr , way to knock it out. good points.

I love nintendo but it is just not in the same league as apple in terms of it's visibility. And it's great to point out that people don't seem to get that companies don't make 'free to play' games because they want to offer us a deal, it's because we all can't resist and it's fantastic advertising. Nintendo has shown us time and again that they have some dopey pride issue that they'd rather advertise with kids raving to their friends about a colorful game than actually produce crafty advertising that reaches millions in one swath.

Like they're not a multi billion dollar corporation but a principled yoga teacher. That's great if you are... that, because it worked once with the Wii for a short period. otherwise it's just bad business and any smart board of investors would have fired Iwata 6 months ago.

I'm not saying it's horrible that they haven't gone mobile but I'm saying they can still do it their own careful way by introducing specific limited experiences with the nintendo shine on it to mobile. How would that take it out of their control? That will hardly have people bailing on their consoles if it's used as a springboard to real deep experiences. The games business has arguably seen a huge boost thanks to mobile users who want more overall anyway. in short get in the game or get trampled by it.

@rjejr What I'd say on minigames such as those in Nintendo Land is that they do, at least, aim to utilise the specific hardware. In the DK one you use the mic or buttons to move certain obstacles (possible on a phone, admittedly), while the Balloon one tries to encourage using both screens, with the GamePad being zoomed in to pop balloons and the TV showing a wider view. As for the F-Zero one, yeah, that didn't necessarily need the GamePad.

All of that is counter to the main point though — which of course can be disagreed with, I expect that — which is that Nintendo's business has an integral relationship and reliance on hardware, especially now. The company differentiates itself, increasingly so, by producing hardware that it wants to develop games for. For consumers now, many want a Nintendo system to primarily play Nintendo games.

Even if you bring retro games to a smart device, I'd argue its the start of a road that can't be left. The Nintendo hardware is suddenly that bit less vital and relevant, and the slippery slope has begun.

In terms of other points in general highlighting other examples (such as the GTA games), the difference again is the hardware dynamic. Rockstar loses nothing by putting GTAIII or GTA: San Andreas on iPad or whatever, because they're old games they'll happily sell again years down the line. It's win-win, and they're a multi-platform business — GTA V is on 360 and PS3, and it seems 99% likely it'll pop up on PS4 and One in 2014.

With some of the examples I gave I was trying to highlight that, even in situations that look unstoppable, the mobile market can fluctuate wildly. It's not a case of "release games on these platforms and watch the dollars pile up", it's not that simple. It's a risk, and if Nintendo can sustain its business with profits and handle ups and downs (which it had before smartphones even existed), then risking that at this stage for a hit/miss market doesn't seem sensible.

Theres a reason we have handheld game systems. NOT for Instagram, there for gaming! People need to realize this, People might want to have handheld consoles delve deeper into IOS and Android gaming and whatnot. But that stray's from the original concept of a handheld console!

Tablets and touch/no touch will, however unfortunate, certainly be the norm pretty soon. Packaging a tablet with the console is thinking ahead. . Yes, possibly ruining even Nintendo's Handheld's reputation...

. Yes, possibly ruining even Nintendo's Handheld's reputation...

If Iwata is looking so far ahead, he should have some assistant looking less far ahead.

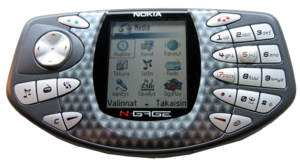

If Nintendo got into the 'phone-biz', I fear it'd turn out like the

Making/having those simple arcadey games is fine; games where the only goal is to beat someone's score... games like Tetris have sold systems. Putting them to iOS/android, etc. is a bad idea, because it trivializes Nintendo's hardware.

With so many "emulators and roms" floating around, that can be used on many platforms for free, it makes no sense to actually PURCHASE games. If you could block those files, it would help Nintendo a bit (but probably a lot).

@NewBond If that "device 6" game scored so high, then it would also be higher than all the PS4/Xboxone titles released so far this year as well, as well (It seemed that the average metacritic score was "6.1").

By the way: the DS family of systems is the biggest-selling handheld console in history (narrowly behind PlayStation 2 in the overall stakes)... That suggests the PS2 was a handheld console...

The day that Nintendo starts releasing games on 3rd party platforms is the day the company dies. Underdog or Kingpin, I am and forever will be a Nintendo loyalist. But please, don't pull a "Sega"...

@Williaint Yeah, the "Device 6" comment was in reference to this: "Device 6 has a higher meteoritic [sic] score than every game released on a Nintendo console this year with the exception of SM3DW. There's no way that game would be any better with a controller."

Ultimately, I see something like the PS Vita/PS4 system, with deeply-integrated function, to be the future of gaming systems. No one is going to remain dominant in the video-game business without controlling the hardware, too. Gaming will almost always be somewhat marginalized on "generic" platforms, like the PC and touch devices. Selling "commodity" hardware in a competitive market will always require external subsidies in the form of software sales/services. It's why the 3DO failed; Trip Hawkins made multiple hardware manufacturers compete against each other with effectively the same device, while he made all the money from the game sales.

Apple stands to become the next dominant game console builder, but they need to figure out how to build an "Apple integrated" controller. I think they should be close by now, based on their raised-display patents from a few years ago.

I might be late to the party but I didn't read all of the comments above me, so sorry if this is a repeat suggestion. I think Nintendo could do one thing in this space that would make me super happy if not drive more sales to handheld/home systems: Unify accounts, and offer free downloads of your already purchased virtual console games for iOS and Android. So if I buy Megan Man X for my WiiU, I can get it for my iPhone/Galaxy for free (or a VERY modest fee--one time for all devices). Obviously, Nintendo's willingness to do that depends on how many systems they think they could move as a result. I have no clue how that would shake out, but I'd like to see it happen.

@BinaryFragger The Circle Pad Pro is no better. Tablets are the interesting ones anyway with a dedicated controller at a table on a stand.

If Nintendo put a simple port of Super Mario Bros., optimized for mobile and with no other changes made, for 99 cents? I'm thinking...10, 20 million downloads probably in the first week. Nintendo is in a unique position where they could really half-donkey the whole thing because they already have the software and the people to port it.

@Darknyht - "I believe it is safe to say that you will see Nintendo games on other consoles/smartphones about the same time that you see Apple Computer port iWork, Garageband, Final Cut Pro, iPhoto and iMovie to Windows"

iTunes? Safari? Or are we only using examples that fit your model, not reality? Apple ports things to make money. Nintendo could make money by porting things, is that your point?

Apple also moved from PC to laptops. Then it moved from laptops to mp3 players. Then it moved from mps players to phones. Then phones to tablets. And it sells more of each of those than Nintendo sells of anything. And there are more Android phones than Apple phones (Even if most of them are barely "smart" by today's standards).

Apple is not really a very good comparison.

@Technosphile They missed out Rockstar and Sega (And to a lesser extent SNK) who are doing very well with their older stuff on Mobile without affecting the newer stuff whatsoever. Square Enix is a bad example (And they don't do the obvious things like support controllers).

@rjejr Actually Apple is a very good comparison. Not by comparing Apple products to Nintendo products but using it as an analogy.

If Apple gave out OS X Mavericks to other manufacturers, what reason would there be to buy a Mac? Apple PCs and laptops are notorious for being overpriced hardware, but people buy them because its the only way to use that OS. It's the same issue with the iOS. I actually prefer iOS to Android but I really like other manufacturers hardware better. Mostly because they offer choice that Apple doesnt (new iPhone vs old iPhone). But I am stuck getting an iPhone because I cant use iOS on that sleek HTC phone...

Nintendo is the same exact way. They have weaker/more unique hardware but it's what you have to buy if you want their software.

@rjejr iTunes is on Windows simply because of the market, and it took a few versions of the iPod for it to get there and even then it runs poorly compared to the Mac version. Safari came to windows and was abandoned because it was a horrible port that ran slow.

And yes, Apple moved into other markets with the laptop, iPod/iPhone, iPad. However, each time it moved on it's own terms and with it's own hardware. Their software products largely still exist solely to market their hardware. Hence why the above apps are not Windows compatible (and never will be) and the iTunes/App Store will always stay locked down to Apple products. Apple hardware without unique and exclusive software will cease to exist. The era between Jobs departure and return to see what happens when Apple becomes just another PC without the distinction of unique software to distinguish it in the market.

How exactly is that any different than Nintendo selling their software exclusively on their hardware to increase sales of their Hardware? Remove the exclusivity of the software and the Hardware becomes a whole lot less appealing and just another console in the market.

@ThomasBW84 - Misread your point, I thought this was another discussion piece, not simply your final take on the matter. Makes your piece read better now actually.

For the record, I wouldn't mind Nintendo giving up home consoles for a portable 3DS/Wii U hybrid - we already have three 3DS in my house, what's 1 more? - but I don't want/expect them to make crappy touchscreen games their livelihood. And really, I get your slippery slope comment, it's not without it's risks (nothing worth gaining ever is) but how many VC games are there on the Wii U? And it's been out for over a year now already. They could probably throw a couple of NES/Gameboy games on Android (I'm not a big Apple fan) w/o losing too much in sales. Do you know anybody who bought a Wii U for VC?

Smartphone gaming is uncontrollable, and for a simple reason: every fool can make smartphone apps/games by now, which means many overconfident and arrogant 'developers' can throw their trash into the market. There's just no scale of quality at all - and the lack of controls makes it easy to just steal ideas and even entire games. The Google Play/App Store aren't even game platforms to begin with - everything might end up there (just try counting all those advisor apps and sound collections).

If Nintendo were to actually develop/release games there, they'd acknowledge the app market as viable competition, which it isn't. Smartphone games have a much lower quality/quantity ratio. Long games are mostly boring/bad/microtans-dependant, and good games are mostly insultingly short. Nintendo games are always good on both parts, providing entertainment combined with lots of content/challenges.

And to quickly get in on Square Enix: they've lost their sense of creativity long ago. Final Fantasy becomes more generic with every part and can only rake in points on great visuals instead of quality gameplay (jiggle physics on Lightning Returns are also pretty pathetic). And now Bravely Default returns to the roots of what made Square big. But they're also mindless/greedy enough to keep trying with their utterly useless 'social card games', which are destined to fail due to being among much better examples on the app market.

The entire app market is just a giant roulette table - if you happen to bring your stuff at the right moment, you're lucky (and rich). But your chances are ridiculously low, and you can't calculate your luck. Even quality titles tend to fail because of missing the right moment.

@Darknyht Haha, Might be the only thing Nintendo and Apple have in common. Very good point, though! Kudos to you!

@rjejr It is not that anyone would buy a Wii U just for VC... but by putting VC content elsewhere... it becomes one less reason to get a Wii U. And having to add virtual controls would make them shoddy ports, regardless of how good the game is, which eventually does tarnish the brand. I know there are controllers available for phones/tablets but if you plan on releasing on those platforms, you cant make an accessory a requirement.

I know there is a slow trickle of VC games to date on the Wii U, but that is not without reason. They are adding new features to each port by adding gamepad support. (I personally think they could do this better by adding a NES mode similar to the current Wii Mode and have one app that can emulate multiple games instead of each game being a separate emulation app... but that is a different story.) The other main reason for slowly releasing VC games is that it gives each game time to sell. If they just released 100 games in a week, people would have to decide which few to get and then would soon forget about the rest. However, by releasing a few each week, thsoe hungry for new games are more likely to buy each week.

I have an iPhone 3GS which is all i see it as, a phone with the ability to do very light computing when travelling, ie: check emails, browsing internet, google maps, phone, text etc and maybe the odd play of fruit ninja or plants VS zombies.

To this day, i can't see how my smart phone could replace my 3DS for gaming, i play on my 3DS a lot more than i do my phone.

@Darknyht - "How exactly is that any different than Nintendo selling their software exclusively on their hardware to increase sales of their Hardware?"

It's different because Safari is on Windows, on Apples own website:

http://support.apple.com/kb/DL1531

It's different b/c iTunes is on Windows:

http://www.apple.com/itunes/download/

You're saying Apple and Nintendo are the same b/c they don't release their software on other systems but Apple does and Nintendo doesn't. That doesnt make them the same, it makes them different. If Nintendo released a couple of old games on other platforms then they would be more like Apple. Not every game. Not only on other devices, a couple of the many many games that Nintendo has sold over the years so that Nintendo can make more money.

@Shadowkiller97 - I'm old enough to remember Apple going the clone route and I know it nearly bankrupted the company and got Jobs back. But at least they tried, and when it failed they moved on. iOS does seem to be better than Android, and the functional app selection is better, but I gave up my iTouch for a 7" tab after Jobs made that sandpaper remark b/c I couldn't fit a 10" tablet in my jacket pocket. And then they made the Mini. (Funniest video moment ever - Jobs saying how "giant, giant" the 1st iPhone screen was, but he never mentions sandpaper once 6:28)

http://www.youtube.com/watch?v=MnrJzXM7a6o

And they tried w/ Safari. And iTunes works on Windows (well most of the time). So they do branch out when it suits them. Nintendo doesn't even seem willing to consider trying. And it's that failure to consider something which bothers me most.

One major difference between Apple and Nintendo - advertising. Commercials. Print. You name it.

@AmazonianBeauty - "a phone with the ability to do very light computing"

check emails

browsing internet

google maps

fruit ninja or plants VS zombies.

I think your idea of light computing is what most adults see as the main use of their home PC, just replace PvZ w/ Candy Crush

@rjejr Maybe heavier computing would be loading Steam retail PC games. Or using developer/designer apps. But yes, I see your point, just add social webs and Youtube in there.

@HyperSonicEXE this is something I wamted to mention. I feel Nintendo needs to emter the smartphone market. The smartphonr market meaning smartphones and not mobile games. A Nintendo made gaming smartphone would be great! Sony attempted something like ot bit it just wasnt up to par. We need something simple and classy. Nintendo could do that

@rjejr

and i think you've just skimmed past the part where i said "when travelling", and yes like most other adults i have a PC at home which i use for the same thing and other things like Software Development, Gaming, Web page development, and finally, i didn't really like Candy Crush, it just seemed like another clone of bejeweled

@rjejr I am not saying Apple and Nintendo are the same exact company... Of course there will be differences because they are two completely different businesses, but the comparison is valid in my opinion.

Also, I do not think your examples of iTunes and Safari are appropriate. Apple is not selling that software.

iTunes is merely a companion app similar to the (to-be-released) Miiverse app or the recent Pokedex app. I do not think anyone would download iTunes for Windows to buy music/videos without an iDevice to play it on. Furthermore, I believe the only reason iTunes for Windows exists is because the original iPods had no internet connections. With every modern iDevice having a way to conect to the internet and having the iTunes store app on the device itself, I could easily see Apple stop supporting iTunes for Windows with little to no consequence.

As for Safari on Windows, I can't believe anyone uses this unless they are running Windows via BootCamp and are too used to it?

Also, I could be wrong but I doubt anyone buys iDevices because their killer app is iTunes and Safari. As opposed to any Nintendo game which is Nintendo's killer app that people buy Nintendo hardware for. Nintendo porting one of their games is very different from Apple porting iTunes/Safari.

@rjejr there are ALOT of differences between applr and nintendo including the very market itself. What foes apple stamfld to lose by putting safati and itunes on Windows? Im not exavtly rushing to get an Apple device forneither of those two half bit pieces of software. Why do people buy apple products? Its not simple programs like those... thats like buying a wii i for google street U. People buy apple hardware for the hardware and operating system, people buy Nimtemdo hardware for Nintendo software (most, i biy ninty hardware because i like emersive experiences). If I no longer need to buy Ninty hardware fr software what happens to that division?

@AmazonianBeauty I think @rjejr meant your light computing terms (independent to where you apply them) are what the average adult does with his/her desktop computer. I understood he meant you give more uses than the average adult to computing, not that you didn't know/have any desktop PC.

"Moving To Smartphones Is Not The Answer For Nintendo"

Of course not!!!

I am a strong Nintendo supporter. I would be completely satisfied if the '4Ds' had a slot for an optional sim card or something, to give the gaming handheld device calling and texting features for people who wanted those features.

Never liked the smartphone market. And I agree that we can have a better experience when playing with actual buttons.

The day Nintendo starts making games for other systems is the beginning of the end. Even smartphones and tablets.

If Nintendo made smartphone games they would cannabalize their handheld business. And without handhelds Nintendo would collapse as a platform holder.

Being a platform holder is what allows Nintendo the breathing room to be experimental with its software. If they became a 3rd party publisher they would become risk adverse and couldn't afford to risk money on franchises that do not sell more than a million copies... No more fire emblem, no more Metroid, no more anything unless it has Mario, Zelda, DK, or Kirby. Yearly releases of there top 4 franchises.

Everything else would be gone, and they would be running with the bare minimum of studios. So no more monolith, no more intelligent systems, no more games from next level or retro.

Yes, I would love to play games like Super Mario 3D Land, Resident Evil: Revelations, Luigi's Mansion, Mario Kart 7 and The Legend of Zelda: A Link Between Worlds on a smartphone... I really wish these idiots who keep suggesting this would just go talk about something else. There is no possible way they could be more clueless of another industry than they are video games.

The dumbest thing any company could do, is attempt to compete by giving the competitor all their assets. The only reason Sega did what they did was because they made the decision to no longer compete. Those people need to wake up, Nintendo is the number one selling game hardware company. Don't mistake the Wii U's current situation for the Nintendo company as a whole.

It's strange that I will not buy an iPhone game at more than $2. But I will buy almost anything $2-$15 on the 3DS eShop and Vita PSN Store.

@billychaos The sense is strong with this one.

Quick additions to the concept: VC on ios? Nope, nintendo will become old school too quickly, and the better games will easily overrun nintendo with a quality perception hurting the brand. Also, people look at the wii without realising it was an exception in a steady market: a fleeting, one hit success. The gamecube, n64, even the super nes until it hit more units at the end, were about break-even concepts. Competition loses the cash consistently though.

What makes nintendo strong is the handheld business. They earn huge profits there. The consoles are the most beautiful catalyst, having people talk about, pay attention to, and evaluate the nintendo brand. Consoles are, in a way, the best marketing asset for nintendo.

We'll see what the future brings, though. I liked the suggestion of rupee harvesting on my iphone, or something, that really optionally expands a fun experience to a mobile device.

This is an extremely thorough article and I wish it would put an end to this discussion that I'm sick of. Unfortunately it won't. People who speak on behalf of Nintendo going on mobile development probably think, that in such case Nintendo's customers would buy the games in addition to the new segment, who wouldn't buy a console to play the games, but this is completely false. I wouldn't buy the mobile games, and I think it's pretty safe to say that neither would pretty much anyone here. In fact, I'd be so p*ssed off, that I wouldn't buy any new Nintendo games or consoles at all. I would probably go fully into retro gaming if it would come to that. They would be trading a loyal customer who has bought all their consoles and games since the very beginning for a 99c casual gamer, who would play their games for 10 minutes in the tram and forget about it.

Why do these articles never touch on the #1 reason why Nintendo (and Sony...MS less so, for a variety of factors) will not go willingly into a software-only role?

**Licensing fees**.

It's amazing it is constantly ignored by people trying to grasp why Nintendo would 'belligerently' hang in on the HW market, despite that 'logic' says they could sell many more copies of their games spread across a half-dozen platforms (itself a very dubious proposition, of course).

Look at it this way: Nintendo might sell 100-150 million units of its own software throughout the lifespan of a given product (e.g. Wii)--a princely sum to be sure--but the overall software market on that platform is 4-5x that, and every one of those games sees Nintendo getting paid for doing, effectively, nothing more than acting as a gatekeeper.

Now, if you take that money away, you're looking at an income shortfall, across one HW product, of potentially billions of dollars--not exactly chump change, and not exactly money Nintendo will willingly walk away from, not because they are belligerent, but because that money is not replaceable, period. Simply putting Mario on iOS/Droid/PS4, etc. will not, in any way, make up for the loss of billions of dollars over a 4-5-year span.

What it boils down to is they simply cannot sell enough copies of their own games to recoup the money they will lose from licensing fees--money they get, again, for a bare minimum of investment.

(These are the 'business reasons' Reggie loosely touched on, I think last week, when asked--for the thousandth time--about going multi-platform. It simply does not make any sense and it will do catastrophic harm to Nintendo once the initial stock surge from going that route runs full on into reality.)

@ejamer

Spot on IMHO. I think it's important that parents know that when they buy their kids a game that initial purchase is what they pay. Yes, say Pokemon X or Donkey Kong Country Returns are £25 and IP but that's it. No worries about little Timmy or Tilly racking up huge charges unseen.

The only thing I've wondered about when it comes to Nintendo and mobile phones is would ere be any mileage in

A) Putting cut down, almost demo versions of some games on them as advertising. Though of course there's control issues as well as the time spent to learn what would be new hardware. Things like Picross, Fire Emblem, Advance Wars and Pokemon.

B) Whether some of the more obscure franchises that are suited to touch screen only play would generate some cash. I'm thinking of Art of Balance, Polarium, Puzzle League, maybe Elite Beat Agents. It could alert people to the quality of Nintendo's games without giving any of the big franchises away (and as long as Nintendo console owners get all the same content and more).

But this is a great read, Thomas, cheers. I'm going to link it up to others who keep coming out with the suggestion Nintendo should go mobile.

Has to be irritating answering the same stupid question for the 1000th time.

There are a few good mobile games (I've recently become addicted to the android port of Ridiculous Fishing), but, as a whole, it is a cesspool and should be avoided by a company like Nintendo that has high standards of quality. Most of the time, in the case of a game called Spider, for instance, the game itself is pretty decent, but the control is really killed for me by the lack of buttons. The best mobile games are very simple and easy to control.

I can honestly say that as long as there are people who play games there will always be a market for dedicated handhelds.

Tbh the only mobile game that I've enjoyed was Sonic Dash. Playing as Shadow is great!

I love horses XDDDDDD

Anyone with the 'digital aptitude' already has Nintendo on their smartphone. For free.

The only reason gaming on smartphones is thought to be so lucrative, is because of the high volume of teenage girls, soccer moms, and business men, far outside the general circle of video game enthusiasts, buying stupid, cheap games that they'll play for 5 minutes a session.

But wait! Doesn't anyone want to play a farming sim with the Master Chief? Maybe a plants vs. zombies featuring Ratchet and Clank? No? Oh, I see. It's an insatiable hunger for Nintendo franchises that fuels this never ending topic.

@electrolite77 - " I think it's important that parents know that when they buy their kids a game that initial purchase is what they pay."

Except I've already paid an additional $9 in DLC for Pikmin 3, how is that any different? Yes it's a Wii U game but that model could very easily be applied to the 3DS. And Pokemon X+Y fans will all be laying out $5 every year for the bank.

Just b/c Nintendo hasn't made a big deal out of extra fees yet doens't mean it isn't coming. They also had Pokemon Rumble U and its extra $5 toys. Hopefully nothing as ridiculous as $100 Smurfberries is on the horizon but your initial claim of "pay once and be done" is fading fast.

@rjejr At least with none Nintendo systems most stuff gets a GOTY version which is what the game should have been from the start.

I agree that Nintendo should avoid developing games for smart devices, nor should they bring their current games to those platforms. However, I don't see classic games originally released on the NES, SNES, GBA, etc. being released on smart devices posing a threat to Nintendo's own platforms. Will gamers stop buying 3DS's and Wii U's when Super Mario Bros. 3 is available on the iPhone yet games like Animal Crossing: New Leaf and Pikmin 3 are not?

The Virtual Console is a wonderful service, but probably not one that does a heck of a lot to drive hardware sales. I would argue that those who prefer their buttons would still buy those games on Nintendo platforms, and those who don't have that preference are in most cases not buying dedicated-gaming devices anyway. Additionally, Nintendo's franchises are still recognizable enough to succeed on smart devices where other properties fail.

I'm curious what the Nintendo Life staff's take on this strategy is.

There is a new Final Fantasy title on mobiles. It is called Final Fantasy Dimensions. It is a good title, yet the controls are hard to get use to. I have an iPhone which is fine for puzzle games or mouse click type games yet it is not suited for RPGs.

Probably 9 out of 10 [at very least] smartphone releases are financial failures. How its considered a smart move is mind boggling. Sony tried this with Playstation All Stars on mobile. Don't know how it did financially, but was reviewed as a failure game, citing it's obscure tether to Coke advertising as well as dismal gameplay. And its very release purely undermined its Vita version. Why would a consumer get both? Just created bad brand recognition for Sony and its All Stars IP

ChuChu Rocket! is the only game I've ever bought for my phone.

Smartphone transition would dilute the Nintendo experience and I'm glad that they can see that! This company holds so much integrity and passion for us as customers and fans. To be honest, touch screen is horrible to play any platformers on in my opinion. Button bashing all the way!

I'm glad someone articulated why this wouldn't be good. I've said it before, visibility matters, and Nintendo wouldn't have that kind of visibility on smartphones for more than a year (probably not even that long). People are so ridiculous with their claims sometimes.

I've said it once, I'll say it again, Iwata was right to say if you want Nintendo software, buy Nintendo hardware.

The only things that would work on smartphone would be virtual console, and most people would balk at the vc prices on their smartphones.

@rjejr the difference is that DLC is not needed to complete the game 100% - DLC is just some added extras that are not needed to win the game.

@Genesaur I've bought all the Kairosoft games for my phone - if Nintendo could get them to release games on Wii U eShop, that would convince more than a few of the million or so world wide Kairosoft fans to buy a Wii U.

I don't know how many times you need to remake articles about this topic, Nintendo stock owners want their stock to temporarily skyrocket so they can sell sell sell, but it's obvious to anyone with 1/2 a brain that undermining your own hardware would be bad for Nintendo in the long run.

Tap here to load 132 comments

Leave A Comment

Hold on there, you need to login to post a comment...